Who we are

We are a team of professional engaged in CIBIL analysis and correction across all the leading credit bureaus of India like CIBIL Transunion, Equiflex, Experian, CRIF. We procure your credit report, analyse it against the various parameters, provide corrective actions to be taken right from settlement to taking legal action & help you update rectified credit information across credit bureaus.

We are the most preferred Credit Advisor

Why you should check your Credit Score?

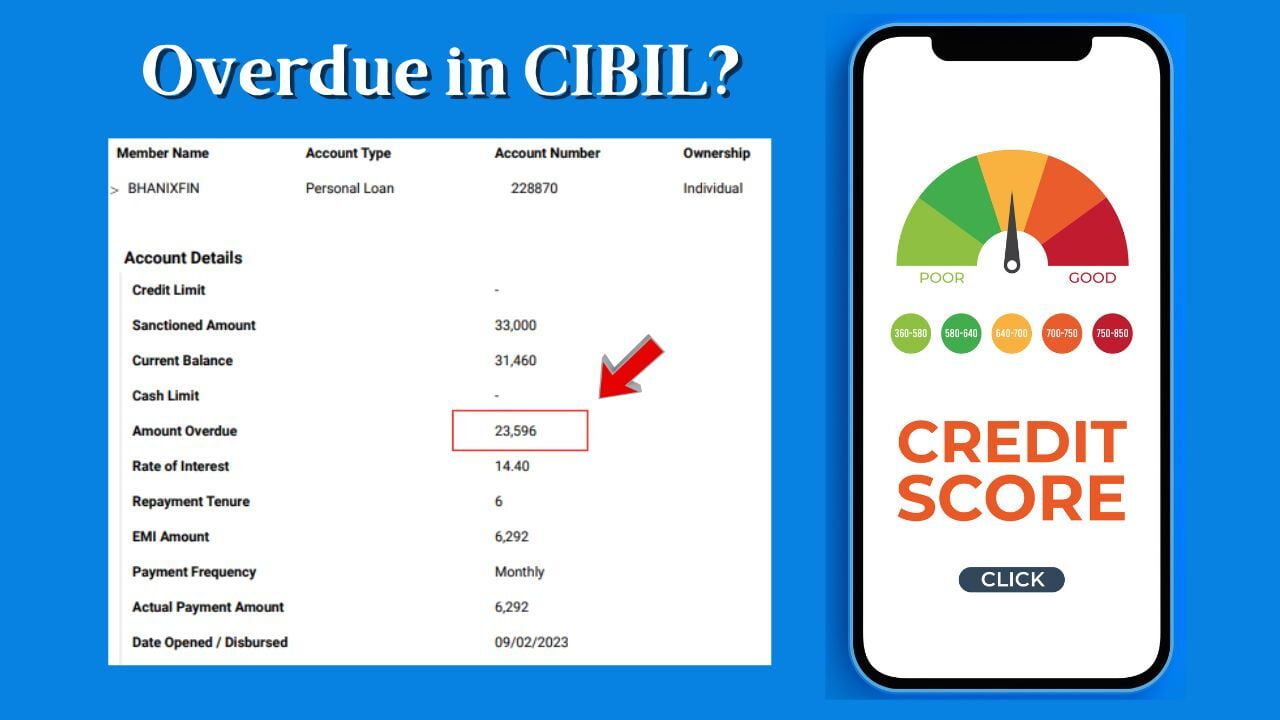

If there is pending dues of some banks or NBFC it keep impacting on CIBIL score but bank would have failed to intimate it to you.

Why is it crucial to keep a good Credit Score?

You will get better rate of interest and a higher eligibility only if you have good credit score.

CIBIL Score Factors

CIBIL Score is a 3-digit number summary of your credit history. The score is derived by using the details found in the "Accounts" and "Enquiries" section on your Credit Information Report (CIR) and ranges from 300 to 900 points. The closer your score is to 900, the more favourably your loan application will be viewed by a lender.

Credit History

Payment History

Past Application

Credit Bureaus in India

The major credit bureaus with whom we do the corrections of the CIBIL reports are given as below